What does an Accountant do?

An accountant is a financial professional responsible for recording, analyzing, and interpreting financial transactions and data for individuals, businesses, and organizations. They play a vital role in ensuring the accuracy and compliance of financial records, preparing financial statements, and providing valuable insights for decision-making. Accountants handle tasks such as bookkeeping, tax preparation, budgeting, and financial analysis.

They possess a strong understanding of financial principles, accounting standards, and relevant laws and regulations. Attention to detail, analytical skills, and proficiency in accounting software are essential for accountants to effectively manage financial information and contribute to the financial success of their clients or employers.

Steps to Becoming an Accountant

- Step 1: Enroll in a degree program

- Step 2: Choose your career path

- Step 3: Find an internship

- Step 4: Complete your degree

- Step 5: Find a job

- Step 6: Get certified

Here’s a breakdown of each step to becoming an accountant:

Step 1: Enroll in a degree program

Start by enrolling in a bachelor’s degree program in accounting or a related field. This education will provide you with a strong foundation in accounting principles, financial analysis, taxation, auditing, and other relevant subjects.

Step 2: Choose your career path

Determine the specific area of accounting you want to pursue. You can specialize in fields like public accounting, management accounting, financial accounting, or forensic accounting. Research different career paths and consider your interests and strengths to make an informed decision.

Step 3: Find an internship

Internships offer valuable hands-on experience and the opportunity to network with professionals in the field. Look for internships at accounting firms, businesses, or government agencies to gain practical exposure to accounting practices and procedures.

Step 4: Complete your degree

Successfully complete your degree program, fulfilling all the necessary coursework and requirements. Ensure you have a strong understanding of accounting principles, financial reporting, tax regulations, and auditing standards.

Step 5: Find a job

Start your job search by applying to accounting firms, corporations, government agencies, or non-profit organizations. Consider networking, attending career fairs, and utilizing online job portals to explore opportunities. Entry-level positions such as staff accountant or junior auditor are often a good starting point.

Step 6: Get certified

To enhance your professional credentials and career prospects, pursue relevant certifications such as the Certified Public Accountant (CPA) or Certified Management Accountant (CMA) designation. These certifications typically require passing exams, meeting experience requirements, and fulfilling continuing education obligations.

By following these steps, you can establish a strong foundation of knowledge, gain practical experience, and earn the necessary certifications to become a successful accountant. Continuous learning and professional development are also crucial throughout your career to stay updated with industry trends and advancements.

Accounting Degrees and Requirements

Here’s a table outlining some common accounting degrees and their requirements:

| Degree | Description | Requirements |

| Bachelor’s in Accounting | A four-year undergraduate degree in accounting. | High school diploma or equivalent. Some programs may have specific GPA requirements or prerequisite courses. |

| Bachelor’s in Finance | A four-year undergraduate degree focusing on finance. | High school diploma or equivalent. Some programs may have specific GPA requirements or prerequisite courses. |

| Master’s in Accounting | A graduate-level degree in accounting. | Bachelor’s degree in accounting or a related field. Some programs may require prerequisite coursework. |

| Master’s in Taxation | A graduate-level degree specializing in taxation. | Bachelor’s degree in accounting or a related field. Some programs may require prerequisite coursework. |

| Certified Public Accountant | Professional certification for public accountants. | Bachelor’s degree, specific accounting coursework, passing the CPA exam, and fulfilling experience requirements. |

| Certified Management | Professional certification for management | Bachelor’s degree, passing the CMA exam, and fulfilling experience requirements. |

| Accountant (CMA) | accountants with expertise in management accounting. | |

| Certified Internal Auditor | Professional certification for internal auditors. | Bachelor’s degree, passing the CIA exam, and fulfilling experience requirements. |

How Long Does it Take to Become an Accountant?

The time it takes to become an accountant can vary depending on several factors, including the educational path chosen, individual circumstances, and career goals. Here are some general timelines:

- Bachelor’s Degree: Obtaining a bachelor’s degree in accounting or a related field typically takes around four years of full-time study. This includes completing the required coursework, general education requirements, and any internships or co-op experiences.

- Master’s Degree: Pursuing a master’s degree in accounting is optional but can provide additional specialization and career advancement opportunities. A master’s program usually takes an additional one to two years of full-time study, depending on the program structure.

- Professional Certification: Many accountants choose to pursue professional certifications such as the Certified Public Accountant (CPA) or Certified Management Accountant (CMA). Becoming certified typically involves meeting education requirements, passing exams, and fulfilling experience requirements. The time needed to prepare for and complete the certification exams can vary, but it generally takes several months to a year or more.

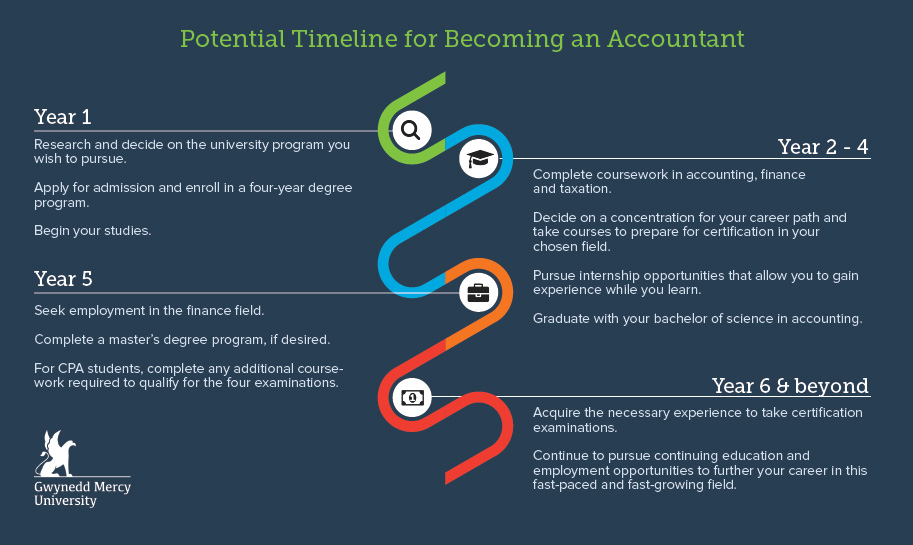

Potential Timeline for Becoming an Accountant:

Jobs and Salary of an Accountant

Here’s a table outlining some common job roles in accounting in India and their average salary ranges.

| Job Role | Description | Salary Range (in INR) |

| Accountant | Responsible for recording and managing financial data. | 2,00,000 – 6,00,000 per annum |

| Tax Consultant | Provides tax planning and advisory services. | 3,00,000 – 8,00,000 per annum |

| Audit Manager | Oversees and manages the auditing process. | 6,00,000 – 15,00,000 per annum |

| Financial Analyst | Analyzes financial data and prepares reports. | 4,00,000 – 10,00,000 per annum |

| Cost Accountant | Manages cost control and analysis in organizations. | 4,00,000 – 12,00,000 per annum |

| Internal Auditor | Conducts internal audits to assess financial controls. | 3,00,000 – 8,00,000 per annum |

| Chartered Accountant (CA) | Offers financial and business advisory services. | 7,00,000 – 25,00,000+ per annum |

| Chief Financial Officer (CFO) | Responsible for the financial management of a company. | 20,00,000 – 1,00,00,000+ per annum |

Frequently Asked Questions

What education do I need to become an accountant?

Typically, a bachelor’s degree in accounting or a related field is required. Some employers may prefer or require a master’s degree for certain positions.

Do I need to become certified to become an accountant?

Certification is not always required, but it can enhance your professional credentials and career prospects. The most common certifications for accountants include the Certified Public Accountant (CPA) and Certified Management Accountant (CMA).

How long does it take to become an accountant?

It generally takes around four years to complete a bachelor’s degree in accounting. Pursuing a master’s degree and obtaining professional certifications may add additional time to the process.

Are internships important for becoming an accountant?

Yes, internships provide valuable practical experience and networking opportunities. They can enhance your resume and make you more competitive in the job market.

What skills are important for accountants?

Strong analytical skills, attention to detail, mathematical proficiency, problem-solving abilities, and proficiency in accounting software are important for accountants. Good communication and interpersonal skills are also valuable for interacting with clients and colleagues.

What career paths can I choose as an accountant?

Accountants can work in various industries, including public accounting firms, corporate finance departments, government agencies, or as self-employed professionals. Specializations include tax accounting, auditing, management accounting, financial accounting, and more.

Is continuing education necessary for accountants?

Yes, staying updated with industry trends and advancements is crucial. Many professional certifications require accountants to fulfil continuing education requirements to maintain their credentials.