What is Financial Analyst?

A financial analyst is a professional who analyzes financial data and provides insights and recommendations to individuals or businesses in order to make informed decisions about investments, budgeting, and financial planning.

Financial analysts use a variety of tools and techniques to analyze financial data, including financial modeling, forecasting, and risk analysis. They may also evaluate the performance of stocks, bonds, and other investment vehicles in order to make recommendations to clients. In addition, financial analysts may prepare reports and presentations to communicate their findings and recommendations to clients or management teams.

Financial analysts may work in a variety of industries, including investment banking, asset management, corporate finance, and financial planning and analysis. They typically have a strong background in finance or accounting and may hold a degree in a related field, such as business, economics, or mathematics.

How to become Financial Analyst?

Becoming a financial analyst typically requires a combination of education, skills, and experience. Here are the steps you can take to become a financial analyst:

- Get a degree: Most financial analysts have at least a bachelor’s degree in finance, accounting, economics, or a related field. Some employers prefer candidates with a master’s degree.

- Gain relevant work experience: Internships, entry-level positions, or other relevant work experience can help you develop the skills and knowledge needed to become a financial analyst.

- Develop financial analysis skills: Financial analysts need to be proficient in financial modeling, forecasting, and data analysis. You can gain these skills through coursework, on-the-job training, or self-study.

- Obtain relevant certifications: Earning certifications, such as the Chartered Financial Analyst (CFA) designation, can improve your chances of getting hired and increase your earning potential.

- Build your network: Networking with other financial professionals can help you learn about job opportunities, gain industry insights, and build relationships that can help advance your career.

- Apply for financial analyst positions: Look for job postings that match your skills and experience, and tailor your application materials to highlight your qualifications for the position.

- Continue learning and developing your skills: The finance industry is constantly evolving, so it’s important to stay up-to-date on industry trends and developments and continue learning new skills to remain competitive in the job market.

Financial Analyst: Eligibility

The eligibility requirements for becoming a financial analyst may vary depending on the employer and the specific job role. However, some general eligibility criteria for becoming a financial analyst are as follows:

- Education: Most financial analysts have at least a bachelor’s degree in finance, accounting, economics, or a related field. Some employers prefer candidates with a master’s degree.

- Skills: Financial analysts need strong analytical, problem-solving, and communication skills. They should be proficient in financial modeling, forecasting, and data analysis.

- Work experience: Relevant work experience, such as internships or entry-level positions in finance or accounting, can help candidates develop the skills and knowledge needed to become a financial analyst.

- Certifications: Earning certifications, such as the Chartered Financial Analyst (CFA) designation, can improve a candidate’s qualifications and increase their chances of getting hired.

- Knowledge of industry regulations: Financial analysts need to be familiar with relevant industry regulations and compliance requirements.

- Computer proficiency: Financial analysts use a variety of software programs to analyze financial data, so proficiency with Microsoft Excel, data visualization tools, and other software is important.

Benefits of Becoming a Financial Analyst

Becoming a financial analyst can offer a range of benefits, including:

- High earning potential: Financial analysts are typically well-compensated, with median salaries in the six-figure range.

- Career growth opportunities: Financial analysts can advance to higher-level positions, such as portfolio manager, investment banker, or finance director.

- Job stability: The finance industry is relatively stable, and financial analysts are in demand across a range of industries.

- Intellectual challenge: Financial analysts need to use their analytical and problem-solving skills to analyze complex financial data and make recommendations.

- Opportunities to work with cutting-edge technology: Financial analysts work with a range of software and technology tools to analyze financial data and create reports.

- Exposure to a range of industries: Financial analysts can work in a range of industries, from healthcare to technology to real estate, giving them exposure to a diverse range of businesses and sectors.

- Opportunity to make an impact: Financial analysts play an important role in helping companies make strategic financial decisions, and their work can have a significant impact on the success of a business.

Roles and Responsibility of Financial Analyst

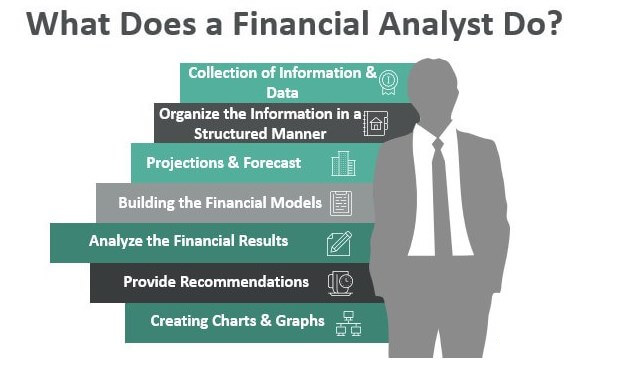

The roles and responsibilities of financial analysts typically include the following:

- Analyzing financial data: Financial analysts are responsible for analyzing financial data, including financial statements, industry trends, and economic indicators, to identify trends and make recommendations.

- Creating financial models: Financial analysts create financial models to project future earnings, revenues, and expenses, and use these models to make recommendations about investments, acquisitions, and other financial decisions.

- Conducting research: Financial analysts conduct research on companies, industries, and markets to gather data and insights that can inform financial decisions.

- Making investment recommendations: Financial analysts use their research and analysis to make investment recommendations to clients or to their employer.

- Presenting findings: Financial analysts create reports and presentations to communicate their findings and recommendations to clients, management, and other stakeholders.

- Monitoring financial performance: Financial analysts monitor the financial performance of companies, investments, and markets to identify opportunities and risks.

- Ensuring compliance: Financial analysts ensure compliance with relevant regulations and internal policies and procedures.

- Collaborating with teams: Financial analysts work collaboratively with other finance professionals, such as accountants, investment bankers, and portfolio managers, to achieve financial goals.

Jobs and Salary of Financial Analyst

| Job Title | Salary Range (per annum) |

| Financial Analyst | INR 3,00,000 – INR 9,00,000 |

| Senior Financial Analyst | INR 6,00,000 – INR 18,00,000 |

| Investment Analyst | INR 4,00,000 – INR 15,00,000 |

| Equity Research Analyst | INR 3,00,000 – INR 12,00,000 |

| Credit Analyst | INR 3,00,000 – INR 12,00,000 |

Financial Analyst: FAQs

Q: What is a financial analyst?

A: A financial analyst is a professional who analyzes financial data, such as financial statements and economic indicators, to help businesses make informed financial decisions.

Q: What education is required to become a financial analyst?

A: A bachelor’s degree in finance, accounting, economics, or a related field is typically required to become a financial analyst. Some employers may prefer candidates with a master’s degree or relevant certifications.

Q: What skills are required to become a financial analyst?

A: Financial analysts need strong analytical, problem-solving, and communication skills. They should be proficient in financial modeling, forecasting, and data analysis.

Q: What certifications can help me become a financial analyst?

A: Earning certifications, such as the Chartered Financial Analyst (CFA) designation, can improve a candidate’s qualifications and increase their chances of getting hired.

Q: What types of companies hire financial analysts?

A: Financial analysts are employed across a range of industries, including banking, consulting, investment management, insurance, and real estate.

Q: What is the salary range for financial analysts?

A: The salary range for financial analysts can vary depending on the company, location, level of experience, and other factors. In India, the salary range for financial analysts typically starts at around INR 3,00,000 per annum and can go up to INR 18,00,000 per annum for senior positions.

Q: What are the career growth opportunities for financial analysts?

A: Financial analysts can advance to higher-level positions, such as portfolio manager, investment banker, or finance director. They can also specialize in a particular area of finance, such as risk management or corporate finance.